Although performance is always the objective, it is our focus on seeking to minimize cyclicality and navigate volatility over the long term that inspires trust.*

*There is no guarantee that EIP will be able to minimize cyclicality or navigate volatility.

Recent Performance

as of 6/30/25

| Quarter | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Inception to Date ** | |

| EIPIX | 0.30% | 7.19% | 22.50% | 17.05% | 18.19% | 7.18% | 9.88% |

| EIPFX | 0.26% | 6.99% | 22.02% | 16.58% | 17.71% | – | – |

| SPTR† | 10.94% | 6.20% | 15.16% | 19.71% | 16.64% | 13.65% | 10.79% |

| AMZX† | -4.91% | 7.06% | 13.16% | 26.11% | 27.96% | 5.60% | 8.43% |

**EIPIX inception date 8/22/2006. ***EIPFX inception date 10/18/16

† The Alerian MLP Total Return Index is a composite of the most prominent energy MLPs calculated by Standards & Poor’s using a float-adjusted market capitalization methodology on a total-return basis. Alerian MLP Index, Alerian MLP Total Return Index “AMZ” and “AMZX” are trademarks of Alerian. The S&P 500 Total Return Index (SPTR) is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

The performance data quoted represents past performance and is no indication of future performance. Historical return data includes the reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694 for the most recent month-end performance.

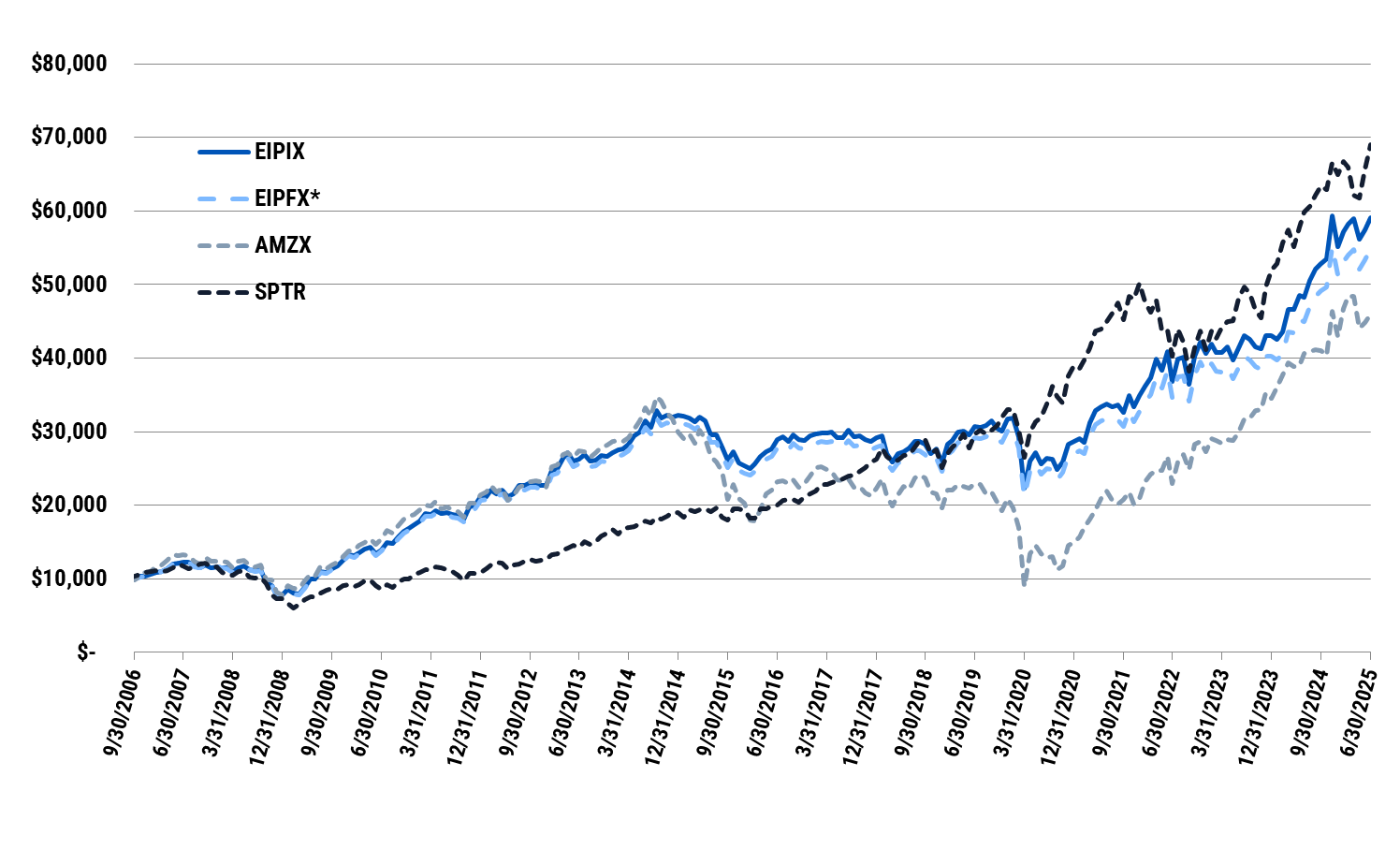

Growth of $10,000

*EIPFX: The gross and net expense ratios include interest expense, Distribution (12b-1) and Administrative Service Plan fees. The expense limitation and reimbursement is a contractual agreement between the Adviser and the Fund that was initiated in February 2017 at a 2.00% expense cap, amended January 1, 2018 to 1.50% and amended again April 29, 2018 to 1.25%, effective until February 28, 2026. If such contractual agreement were not in place, the Fund’s performance would be reduced during that time period.

The Class I Shares (EIPIX) commenced operations on 08/22/2006, performance shown of the Investor Class Shares (EIPFX) prior to inception, 10/18/16, is based on the performance of the EIPIX Shares, adjusted for the higher expenses applicable to Investor Class Shares including the 12b-1 fee and the administrative services fee. This performance has not been experienced by any Investor Class shareholder and there is no assurance that the Investor Class shareholder will experience this performance in the future.

The performance data quoted represents past performance and is no indication of future performance. Historical return data includes the reinvestment of dividends and capital gains. Investment return and principal value will fluctuate so that investor shares when redeemed may be worth more or less than their original costs; and the current performance may be lower or higher than the performance quoted. Please call 1-844-766-8694 for the most recent month-end performance.

The Fund was registered under the Investment Company Act of 1940 on August 22, 2006 and offered through a confidential private placement memorandum. On October 14, 2016, Fund shares were registered under the Securities Act of 1933. The Fund performance is net of actual fees and expenses incurred by the Fund.

Top Ten Holdings

| Energy Transfer, L.P. | 8.62% |

|---|---|

| Enterprise Products Partners, L.P. | 5.75% |

| MPLX, L.P. | 5.32% |

| National Fuel Gas Co | 3.91% |

| ONEOK, Inc. | 2.67% |

| Clearway Energy Inc | 2.39% |

| Imperial Oil Ltd | 2.38% |

| Exxon Mobil Corp | 2.33% |

| Sunoco LP | 2.16% |

| Shell PLC | 2.10% |

Top Ten Holdings (% of equity) as of 6/30/2025. Top Ten Holdings are subject to change at any time.

Net Sector Allocation Charts

Portfolio by Business Sector

- Petroleum Transmission

- Natural Gas Transmission

- Terminals & Storage

- Other Midstream

- Regulated Power

- Other

Portfolio by Asset Class

- MLP-LP Units

- GP MLP & C-Corp

- YieldCo & Other

- Electric & Gas Utilities

Allocations are given as a % of equity

Portfolio allocation charts represent the total equity exposure of the portfolio as a percentage of net assets (unaudited). Source: EIP calculations based upon Corporate Reports as of 6/30/25 for the EIP Growth and Income Fund. There is no guarantee that future Fund diversification metrics will be similar to those above. EIP reserves the right to concentrate its investments in any combination that it deems appropriate and may change the concentration and weightings, at any time, at EIPs sole discretion. Charts exclude bond and cash positions.

Fees and Minimums

PURCHASE OF SALES

| Class I | Investor Class | |

|---|---|---|

| Investment Minimum | $1,000,000 | $2,500 |

| Add’l Investment Minimum | None | $100 |

ANNUAL FUND OPERATING EXPENSES

| Class I | Investor Class | |

|---|---|---|

| Gross Expense Ratio^ | 1.72% | 2.12% |

| Net Expense Ratio^ | 1.25% | 1.65% |

| Expense Cap^ | 1.25% | 1.25% |

| Distribution (12b-1) Fee | No Shareholder Fees | 0.25% |

| Service Fee | No Shareholder Fees | 0.15% |

^EIPIX: The gross and net expense ratios include interest expense. The expense limitation and reimbursement is a contractual agreement between the Adviser and the Fund that was initiated in February 2017 at a 2.00% expense cap, amended January 1, 2018 to 1.50% and amended again April 29, 2018 to 1.25%, effective until February 28, 2026. If such contractual agreement were not in place, the Fund’s performance would be reduced during that time period.

^EIPFX: The gross and net expense ratios include interest expense, Distribution (12b-1) and Administrative Service Plan fees. The expense limitation and reimbursement is a contractual agreement between the Adviser and the Fund that was initiated in February 2017 at a 2.00% expense cap, amended January 1, 2018 to 1.50% and amended again April 29, 2018 to 1.25%, effective until February 28, 2026. If such contractual agreement were not in place, the Fund’s performance would be reduced during that time period.

DISTRIBUTION DETAILS

| Class I | Investor Class | |

|---|---|---|

| Record Date | 6/24/25 | 6/24/25 |

| Ex-Date | 6/25/25 | 6/25/25 |

| Payment Date | 6/25/25 | 6/25/25 |

| Distribution Rate/Share | $0.135 | $0.117 |

The Fund was registered under the Investment Company Act of 1940 on August 22, 2006 and offered through a confidential private placement memorandum. On October 14, 2016, Fund shares were registered under the Securities Act of 1933. The Fund performance is net of actual fees and expenses incurred by the Fund.

EIP Growth and Income Fund (EIPIX) received an overall Morningstar Rating of 3 stars out of 91 Energy Limited Partnerships funds as of 6/30/2025. Based on a weighted average of the Fund’s 3-, 5- and 10-year returns.

The Morningstar RatingTM for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Past performance is no guarantee of future results. Morningstar Rating is for the I-share class only; other classes may have different performance characteristics.

With respect to the Energy Limited Partnerships funds, EIP Growth and Income Fund received a Morningstar Rating of 1 star for the three and five-year periods and 5 star for the ten- year periods, out of 91, 90 and 62 Energy Limited Partnership fund respectively, as of 6/30/2025